What is rapid innovation?

Innovation in large companies is a challenge. But speeding time to market is key to winning in innovation economy, so fast innovation is a necessity.

We have talked about the “Rapid innovation” model, creating an external entity dedicated to fast innovation:

- flexible, agile, open to new opportunities picked out from the innovation market, driven by “creative tension“, it has strong assets to create and develop new products and associated leadership platform;

- in the same time, it maintains coordination with the core company (forging persistent connections between innovators and mainstream operations, and cultivating communication and collaboration skills) and alignement with core co innovation strategy, with a view to engage core co in the targeted innovation following “a line of least resistance“.

Osman Can Ozcanli speaks about “in vitro method” designed for large company, a quite similar approach to “Rapid innovation”: assuming that “innovation is the task of creative and risk taking individuals and small teams“, “in vitro method” consists in finding these kinds of people, and letting them free in a flexible framework that I find very compelling:

- “Tell them you want them to innovate, give them a budget and some direction to work with, and let them experiment.

- Help them select a product concept that is in line with your family of products.

- Don’t get in their way, just finance them.

- Let them own the vision for their product, but give them deadlines.

- Let them start their own company, hold their hands just a little.

- Let them produce and start selling when the time is right.

- If you want, draft an agreement that lets you buy their company for whatever its value if it all becomes successful later on.”

Osman believes that “this innovation team will not only create an innovative product, but in about five years, they will create a brand and it will be a true brand that represents their passion behind the product.” What’s the risk? “If it fails, it is their failure. You just lost money. But If they make it, buy the company! The only risk was in financing their prototype – which believe me – ended up much cheaper than if you had paid your own engineers to do it. ”

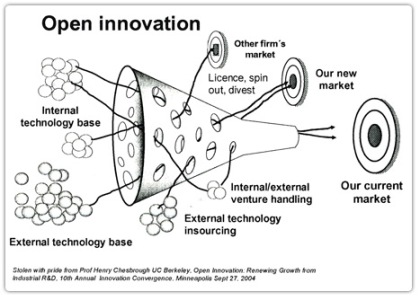

What is Open innovation?

This brings us one step closer to Open innovation. Open innovation as Henry Chesbrough puts it is “a process that starts with looking outside the organisation as you think about things to do inside. It is about “using other people’s wheels” to get you moving”, and breaking boundaries to look for innovation in the outside world.

Started in 2002, Open innovation has gone through three significant phases:

- collecting from outside and bringing external ideas into a company’s own innovation process; this approach has some comunalities with Futures thinking framework: asking the question, scanning the world, mapping the possibilities, and asking the next question;

- developing new business out of collaboration involving companies making their unused ideas and technologies available to others, or sharing their recipe in their industry, finding a path in between collaboration and competition;

- creating new business models arising from opening up the process, opening the doors to cocreation, and customer communities driving a business.

Open innovation has been adopted by Procter & Gamble (P&G) in its innovation strategy since 2002, building the Connect and Develop model. I’ve met more recently with two other large companies, EDF and Veolia (French huge utilities), which have build their own approach, deriving the Open innovation model.

How does Open innovation work?

Let’s go through 3 major innovation steps , Create, Develop, and Engage, and see what we learn from these experiences, and how it matches with “Rapid innovation” approach.

1. Create

- As explained in HBR “P&G, new innovation model” by Larry Huston et Nabil Sakka, VP innovation and senior VP R&D at P&G, it’s in 2002, following a brainstorming about Pringles requiring new process, that “P&G, instead of investing on developing a workable process, created a technology brief defining the problems it needed to solve, and circulated it throughout its global networks of individuals and institutions to discover if anyone in the world had a readymade solution”. They happened to find in an Italian bakery an adaptable method that solved its problem. “This innovation has helped the North America Pringles business achieve double-digit growth over the past two years.” P&G knew best innovations had come from connecting ideas across internal businesses, and that external connections could produce highly profitable innovations, too. Accordingly, newly appointed CEO, A.G. Lafley made it P&G goal to “acquire 50% of our innovations outside the company“. “Connect and Develop program, driven by the top leaders in the organization, was set up to find good ideas and bring them in to enhance and capitalize on internal capabilities”. “P&G taps closed proprietary networks (70 technology entrepreneurs based around the world) and open networks (NineSigma, InnoCentive, YourEncore, Yet2.com). Using these networks, P&G look for ideas in government and private labs, as well as academic and other research institutions; P&G tap suppliers, retailers, competitors, development and trade partners, VC firms, and individual entrepreneurs.” P&G met Lafley goal four years later and the share is now about 60 per cent.

- EDF Business Innovation was created in 2001 by Sebastien Jumel at EDF with a view to incubate and accelerate innovation, being a kind of missing link between R&D and market, a powerful R&D at EDF and a progressively deregulated market. EDF Business Innovation belongs to the Corporate Venture approach. It focused on recognizing, identifying innovations from outside, completing selection based on explicit criteria (intrinsec value and strategic synergy), finding innovations unknown from the R&D, and complementing internal know-how. Setting-up innovation networks in the Silicon Valley, among start-up and VCs to address innovation market was the sinews of war. EDF Business Innovation was composed of 20 people (representatives from EDF business lines, researchers, business developers) and has been part of Strategy & R&D Division, then Development division: . It has achieved 20 investments in 4 years time between 2001 and 2005.

- Veolia initiated the Innovation Accelerator program in 2010 in the context of abundant clean tech market. It built a platform to settle partnerships with clean tech start-up, harvest developments, enhance market & technology intelligence, and develop innovation speed to protect market share and profitability. It is based on the belief that “It is not the strongest who will survive, but those who can most easily adapt”. Innovation Accelerator program targets to complete 4 successful partnerships in one year. Handled by Marie-Anne Brodschii and Robert Bozza, it is part of Veolia Environement Research & Innovation division, and is composed of 10 people.

2. Develop

- Following a screening process that involves busines line (see below : “Engagement”), P&G external business development (EBD) group contacts the product’s manufacturer and begins negotiating licensing, collaboration, or other deal structures. Some arrangements both license to and license from the same company. “At this point, the product found on the outside has entered a development pipeline similar in many ways to that for any product developed in-house.” This proved to work well with large companies, but part of P&G’s challenge is now to learn how to work better with small and medium-sized companies, and entrepreneurs. Jeff Weedman, head of the 2010 Connect & Develop programme, says: “It’s normal for new partners to have a concern that they will be overwhelmed” and that “some small entrepreneurs don’t have the patience to work through” P&G’s exhaustive procedures.

- EDF had created “Ease energie program” to work more closely with start-up: it consisted in exchanging engineers resources against capital share. EDF engineers had a very rewarding experience, understanding the start-up engine to facilitate further integration of the technology within EDF. Coming back to day to day work at EDF was not always easy.

- Veolia completes pilot projects, enabling start-up to test their innovation in the field; agreements are drafted between partner to ease cooperation, Veolia calls it “points de confort”.

3. Engage

- For Connect and Develop to work, P&G realized, “it was crucial to know exactly what it was looking for, or where to play”. They would seek ideas that had some degree of success already, and directed their surveillance to three environments: top ten consumer needs, adjacencies (new products or concepts that can help take advantage of existing brand equity), technology game boards (technology acquisition move in one area affecting products in other categories). We see all this preparation work, completed hand in hand with the core co and business units leaders, as a most efficient way to ensure engagement on the innovations brought back from outside. Starting from logging the external product into online “eureka catalog”, screening process rapidly involves the business line who will “assess its alignment with the goals of the business, gauge the product’s business potential and subject it to a battery of practical questions–such as whether P&G has the technical infrastructure needed to develop the product– meant to identify any showstopping impediments to development.” P&G deeply pushed its culture, “telling its R&D staff that they should start by finding out whether relatedwork had been done elsewhere in the company, then if an external source–a partner or supplier, for instance – had a solution, before considering inventing a solution from scratch”. P&G is now adapting its goal: “Instead of just focusing on the number [of external partnerships], let’s focus on the value we can create. When we get those really, really big ideas, we want to scale them more quickly across the company and use them in more places across the company.” says Bruce Brown, P&G’s chief technology officer.

- EDF Business Innovation had defined 4 stragic business domains, associated with 4 sponsors to prepare managers buy-in. Axes for innovation were set up upstream, and a monthly innovation portfolio review was handled. EDF Business Innovation team was able to inolve EDF buyers and specialists on a specific topic. Engagement can be long and inconsistancy may happen in large companies: one has to buy some time to create porosity between innovation and mainstream operations; also “the more autonomous and fastest you are, the less chance you have to reintegrate smoothly innovation into core co business lines”. Therefore, EDF Business Innovation had learned to build networks of allies and sometimes to move in concentric circles, finding bit by bit new allies in the hierarchy chart.

- External technologies are further integrated into Veolia service portfolio through commercial deals, so that Veolia and its partner are able to win together some new markets thanks to enriched service portfolio and Veolia extensive sales forces; to facilitate engagement, Veolia accelarator program works internally on collecting needs, interviewing business unit and program leaders, and setting-up roll-out priorities; it involves business units at the primary stage of clean-tech assessement. In the course of this process, Veolia accelerator program has built a map of internal innovation skills, a list of influencers, a marketing intelligence through a network of market researchers and worked on understanding resistance and getting support. Because research is quite decentralized at Veolia, these connections lead also to discovering unknown internal innovations!

In what ways is Open innovation an approach for fast innovation?

Open innovation meets “Rapid innovation” model in the Creation phase, in the sense that it feeds creation stage with external ideas, selected from an innovation market. “Creation tension“, one of the three pillars of “rapid innovation” model can be leveraged in an open innovation approach, notably in the Diversity, Focus (fast iterative prototyping, short cycle), Leadership (narrow scope, metaphor & belief) dimensions.

Development stage can be faster as well if handled by the small external partner, or, because external process is already operational, products often move more quickly from concept to market.

But Engagement still remains the most difficult part as in the “Rapid innovation” model. It is all the more painful here that innovation come from the outside market: achieving buy-in from the core co is not easy, fear will drive rejection, and has to be anticipated from the start as in the P&G methodology.

The main lever is: prepare acceptance, create necessity for change.

Speaking of speed, what actually deeply changes in the Open innovation approach is the impact on growth following market initial penetration: the Geoffrey Moore crossing of the chasm, at a global scale. It brings the ability to deliver the kind of rapid growth and scale that would have taken a smaller company years or decades to attain on its own”: “When we go global, you will go global. And it will be very quick” claims Jeff Weedman, head of the Connect & Develop programme at P&G.

Do push the rapid part, it is something we are all scouting around to formulate and work from across all innovation activity

Thks, you can download a slideware summarizing my thesis on Rapid innovation at https://nbry.wordpress.com/2010/06/10/rapid-innovation-a-must-have-in-globalization-time/

Thank you for sharing, a very easy to read but informative document- getting more to understand “why fast innovation” would be useful and relevant.